About Pacific Prime

About Pacific Prime

Blog Article

The Greatest Guide To Pacific Prime

Table of ContentsThe 2-Minute Rule for Pacific PrimeOur Pacific Prime IdeasGetting The Pacific Prime To WorkPacific Prime Can Be Fun For AnyoneGet This Report about Pacific Prime

Insurance policy is an agreement, stood for by a plan, in which a policyholder gets financial security or compensation against losses from an insurer. The firm swimming pools clients' threats to pay much more inexpensive for the insured. Many individuals have some insurance policy: for their cars and truck, their house, their medical care, or their life.Insurance policy also aids cover prices linked with liability (lawful responsibility) for damage or injury created to a 3rd party. Insurance coverage is an agreement (plan) in which an insurance company compensates another against losses from details contingencies or dangers. There are several kinds of insurance coverage. Life, health, house owners, and automobile are among the most common kinds of insurance coverage.

Investopedia/ Daniel Fishel Lots of insurance coverage types are available, and essentially any type of specific or service can discover an insurance provider prepared to guarantee themfor a rate. Usual personal insurance plan kinds are automobile, health and wellness, house owners, and life insurance policy. Many people in the USA have at the very least among these kinds of insurance coverage, and cars and truck insurance coverage is needed by state regulation.

Facts About Pacific Prime Revealed

Locating the price that is appropriate for you requires some legwork. The policy limitation is the optimum amount an insurance provider will certainly spend for a covered loss under a plan. Optimums might be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the policy, additionally recognized as the life time maximum.

There are several different types of insurance. Health and wellness insurance policy assists covers regular and emergency clinical care prices, often with the option to include vision and dental solutions independently.

Lots of preventive solutions may be covered for cost-free before these are fulfilled. Medical insurance may be bought from an insurance business, an insurance coverage representative, the government Health and wellness Insurance Industry, supplied by a company, or federal Medicare and Medicaid insurance coverage. The federal government no longer needs Americans to have health insurance policy, yet in some states, such as California, you might pay a tax obligation penalty if you don't have insurance coverage.

10 Easy Facts About Pacific Prime Shown

As opposed to paying out of pocket for automobile mishaps and damage, individuals pay yearly premiums to an auto insurer. The company then pays all or a lot of the protected expenses related to a car mishap or various other car damage. If you have a rented car or obtained cash to get a car, your lender or renting dealer will likely require you to lug car insurance.

A read life insurance policy plan guarantees that the insurer pays an amount of cash to your recipients (such as a spouse or youngsters) if you die. In exchange, you pay premiums during your life time. There are 2 main kinds of life insurance policy. Term life insurance covers you for a certain period, such as 10 to two decades.

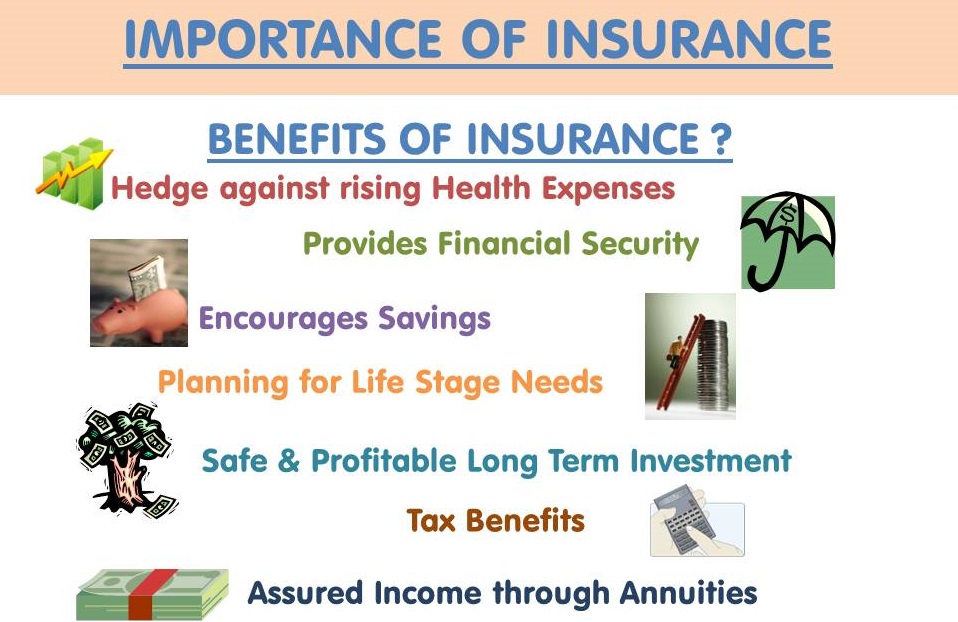

Insurance coverage is a means to handle your monetary threats. When you buy insurance coverage, you acquire protection against unforeseen economic losses. The insurer pays you or a person you choose if something bad happens. If you have no insurance policy and a crash takes place, you may be in charge of all related expenses.

Not known Factual Statements About Pacific Prime

There are many insurance coverage plan kinds, some of the most usual are life, health and wellness, home owners, and vehicle. The right kind of insurance for you will certainly rely on your goals and financial circumstance.

Have you ever before had a moment while looking at your insurance coverage policy or shopping for insurance policy when you've thought, "What is insurance coverage? And do I truly need it?" You're not the only one. Insurance policy can be a mystical and confusing point. How does insurance policy work? What are the advantages of insurance? And how do you locate the very best insurance for you? These are usual questions, and fortunately, there are some easy-to-understand responses for them.

No one desires something negative to occur to them. However experiencing a loss without insurance policy can place you in a difficult financial circumstance. Insurance coverage is a vital monetary device. It can aid you live life with fewer worries understanding you'll get economic aid after a calamity or mishap, assisting you recuperate faster.

4 Easy Facts About Pacific Prime Described

And in many cases, like vehicle insurance policy and employees' settlement, you may be called for by regulation to have insurance policy in order to secure others - international health insurance. Learn more about ourInsurance alternatives Insurance coverage is essentially a gigantic wet day fund shared by many individuals (called insurance policy holders) and managed by an insurance policy provider. The insurance provider utilizes money accumulated (called premium) from its policyholders and other financial investments to pay for its operations and to accomplish its pledge to policyholders when they sue

Report this page